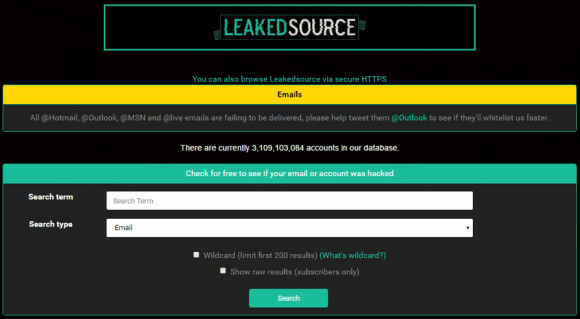

Late last month, multiple news outlets reported that unspecified law enforcement officials had seized the servers for Leakedsource.com, perhaps the largest online collection of usernames and passwords leaked or stolen in some of the worst data breaches — including billions of credentials for accounts at top sites like LinkedIn, Myspace, and Yahoo.

In a development that could turn out to be deeply ironic, it seems that the real-life identity of LeakedSource’s principal owner may have been exposed by many of the same stolen databases he’s been peddling.

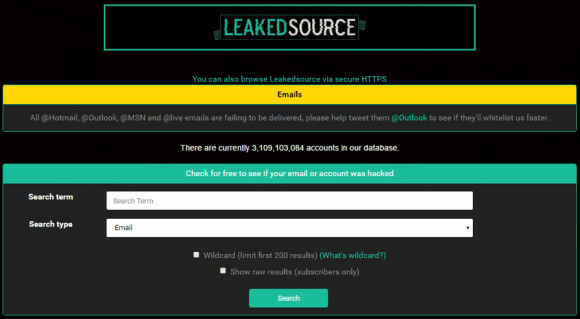

The now-defunct LeakedSource service.

LeakedSource in October 2015 began selling access to passwords stolen in high-profile breaches. Enter any email address on the site’s search page and it would tell you if it had a password corresponding to that address. However, users had to select a payment plan before viewing any passwords.

LeakedSource was a curiosity to many, and for some journalists a potential source of news about new breaches. But unlike services such as BreachAlarm and HaveIBeenPwned.com — which force users to verify that they can access a given account or inbox before the site displays whether it has found a password associated with the account in question — LeakedSource did nothing to validate users. This fact, critics charged, showed that the proprietors of LeakedSource were purely interested in making money and helping others pillage accounts.

I also was curious about LeakedSource, but for a different reason. I wanted to chase down something I’d heard from multiple sources: That one of the administrators of LeakedSource also was the admin of abusewith[dot]us, a site unabashedly dedicated to helping people hack email and online gaming accounts.

Abusewith[dot]us began in September 2013 as a forum for learning and teaching how to hack accounts at Runescape, a massively multiplayer online role-playing game (MMORPG) set in a medieval fantasy realm where players battle for kingdoms and riches.

The currency with which Runescape players buy and sell weapons, potions and other in-game items are virtual gold coins, and many of Abusewith[dot]us’s early members traded in a handful of commodities: Phishing kits and exploits that could be used to steal Runescape usernames and passwords from fellow players; virtual gold plundered from hacked accounts; and databases from hacked forums and Web sites related to Runescape and other online games.

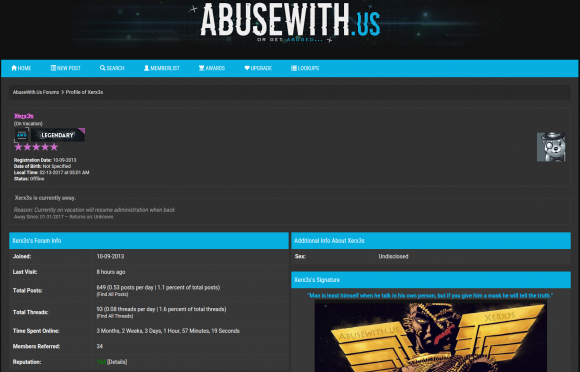

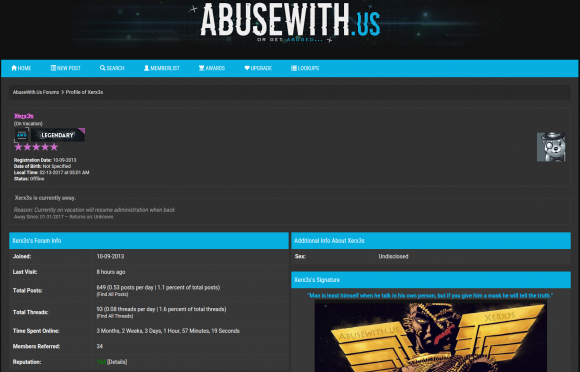

The administrator of Abusewith[dot]us is a hacker who uses the nickname “Xerx3s.” The avatar attached to Xerx3s’s account suggests the name is taken from Xerxes the Great, a Persian king who lived during the fifth century BC.

Xerx3s the hacker appears to be especially good at breaking into discussion forums and accounts dedicated to Runescape and online gaming. Xerx3s also is a major seller of Runescape gold — often sold to other players at steep discounts and presumably harvested from hacked accounts.

Xerx3s’s administrator account profile at Abusewith.us.

I didn’t start looking into who might be responsible for LeakedSource until July 2016, when I sought an interview by reaching out to the email listed on the site (leakedsourceonline@gmail.com). Soon after, I received a Jabber chat invite from the address “leakedsource@chatme.im.”

The entirety of that brief interview is archived here. I wanted to know whether the proprietors of the service believed they were doing anything wrong (we’ll explore more about the legal aspects of LeakedSource’s offerings later in this piece). Also, I wanted to learn whether the rumors of LeakedSource arising out of Abusewith[us] were true.

“After many of the big breaches of 2015, we noticed a common public trend…’Where can I search it to see if I was affected?’,” wrote the anonymous person hiding behind the leakedsource@chatme.im account. “And thus, the idea was born to fill that need, not rising out of anything. We are however going to terminate the interview as it does seem to be more of a witch hunt instead of journalism. Thank you for your time.”

Nearly two weeks after that chat with the LeakedSource administrator, I got a note from a source who keeps fairly close tabs on the major players in the English-speaking cybercrime underground. My source told me he’d recently chatted with Xerx3s using the Jabber address Xerx3s has long used prior to the creation of LeakedSource — xerx3s@chatme.im.

Xerx3s told my source in great detail about my conversation with the Leakedsource administrator, suggesting that either Xerx3s was the same person I spoke with in my brief interview with LeakedSource, or that the LeakedSource admin had shared a transcript of our chat with Xerx3s.

Although his username on Abusewith[dot]us was Xerx3s, many of Xerx3s’s closest associates on the forum referred to him as “Wade” in their forum postings. This is in reference to a pseudonym Xerx3s frequently used, “Jeremy Wade.”

![An associate of Xerx3s tells another abusewith[dot]us user that Xerx3s is the owner of LeakedSource. That comment was later deleted from the discussion thread pictured here.](./media/4fa5f417.xerownsit-580x252.png)

An associate of Xerx3s tells another abusewith[dot]us user that Xerx3s is the owner of LeakedSource. That comment was later deleted from the discussion thread pictured here.

One email address this Jeremy Wade identity used pseudonymously was

imjeremywade@gmail.com. According to a “reverse WHOIS” record search ordered through

Domaintools.com, that email address is tied to two domain names registered in 2015:

abusing[dot]rs, and

cyberpay[dot]info. The original registration records for each site included the name “Secure Gaming LLC.”

The “Jeremy Wade” pseudonym shows up in a number of hacked forum databases that were posted to both Abusewith[dot]us and LeakedSource, including several other sites related to hacking and password abuse.

For example, the user database stolen and leaked from the DDoS-for-hire service “panic-stresser[dot]xyz” shows that a PayPal account tied to the email address eadeh_andrew@yahoo.com paid $5 to cover a subscription for a user named “jeremywade;” The leaked Panicstresser database shows the Jeremywade account was tied to the email address xdavros@gmail.com, and that the account was created in July 2012.

The leaked Panicstresser database also showed that the first login for that Jeremywade account came from the Internet address 68.41.238.208, which is a dynamic Internet address assigned to residential customers of Comcast Communications in Michigan.

According to a large number of forum postings, it appears that whoever used the xdavros@gmail.com address also created several variations on that address, including alexdavros@gmail.com, davrosalex3@yahoo.com, davrosalex4@yahoo.com, as well as themarketsales@gmail.com.

The Gmail account xdavros@gmail.com was used to register at least four domain names almost six years ago in 2011. Two of those domains — daily-streaming.com and tiny-chats.com — were originally registered to a “Nick Davros” at 3757 Dunes Parkway, Muskegon, Mich. The other two were registered to a Nick or Alex Davros at 868 W. Hile Rd., Muskegon, Mich. All four domain registration records included the phone number +12313430295.

I took that 68.41.238.208 Internet address that the leaked Panicstresser database said was tied to the account xdavros@gmail.com and ran an Internet search on it. The address turned up in yet another compromised hacker forum database — this time in the leaked user database for sinister[dot]ly, ironically another site where users frequently post databases plundered from other sites and forums.

The leaked sinister[dot]ly forum database shows that a user by the name of “Jwade” who registered under the email address trpkisaiah@gmailcom first logged into the forum from the same Comcast Internet address tied to the xdavros@gmail.com account at Panicstresser.

I also checked that Michigan Comcast address with Farsight Security, a security firm which runs a paid service that tracks the historic linkages between Internet addresses and domain names. Farsight reported that between 2012 and 2014, the Internet address 68.41.238.208 was tied to no-ip.biz, popular “dynamic IP” service.

No-ip.biz and other dynamic IP address services are usually free services that allow users to have Web sites hosted on servers that frequently change their Internet addresses. This type of service is useful for people who want to host a Web site on a home-based Internet address that may change from time to time, because services like No-ip.biz can be used to easily map the domain name to the user’s new Internet address whenever it happens to change.

Unfortunately, these dynamic IP providers are extremely popular in the attacker community, because they allow bad guys to keep their malware and scam sites up even when researchers mange to track the attacking IP address and convince the ISP responsible for that address to disconnect the malefactor. In such cases, dynamic IP services allow the owner of the attacking domain to simply re-route the attack site to another Internet address that he controls.

Farsight reports that the address 68.41.238.208 maps back to three different dynamic IP domains, including “jwade69.no-ip.biz,” “wadewon.no-ip.biz,” and “jrat6969.zapto.org.” That first dynamic address — jwade69.no-ip.biz — was included among several hundred others in a list published by the Federal Bureau of Investigation as tied to the distribution of Blackshades, a popular malware strain that was used as a password-stealing trojan by hundreds of paying customers prior to May 2014.

XERX3S HACKED?

In January 2017, when news of the alleged raid on LeakedSource began circulating in the media, I began going through my notes and emails searching for key accounts known to be tied to Xerx3s and the administrator of Abusewith[dot]us.

Somehow, in the previous three months I’d managed to overlook an anonymous message I received in mid-September from a reader who claimed to have hacked the email account themarketsales@gmail.com, one of several addresses my research suggested was tied to Xerx3s.

The anonymous source didn’t say exactly how he hacked this account, but judging from the passwords tied to Xerx3s’s other known accounts that were included in the various forum database leaks listed above it may well have been because Xerx3s in some cases re-used the same password across multiple accounts.

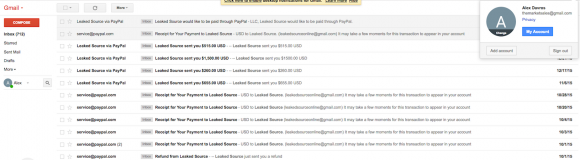

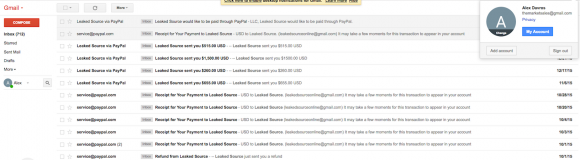

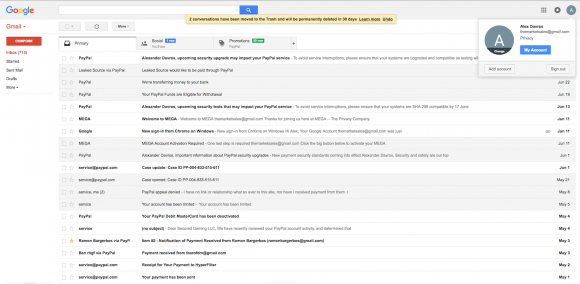

My anonymous source shared almost a dozen screenshots of his access to themarketsales@gmail.com, which indicate the name attached to the account was “Alex Davros.” The screenshots also show this user received thousands of dollars in Paypal payments from Leakedsource.com over a fairly short period in 2015.

The screenshots also showed that themarketsales@gmail.com was tied to a PayPal account assigned to a Secured Gaming LLC. Recall that this is the same company name included in the Web site registration records back in 2011 for daily-streaming.com and tiny-chats.com.

A screenshot shared with me in Sept. 2016 by an anonymous source who said he’d hacked the Gmail address “themarketsales@gmail.com”.

In addition, the screenshot above and others shared by my source indicate that the same Paypal account tied to themarketsales@gmail.com was habitually used to pay a monthly bill from Hyperfilter.com, a company that provides DDoS protection and hosting and which has long been the provider used by Abusewith[dot]us.

Finally, the anonymous hacker shared screenshots suggesting he had also hacked into the email account desiparker18@gmail.com, an account apparently connected to a young lady in Michigan named Desi Parker. The screenshots for Ms. Parker suggest her hacked Gmail account was tied to an Apple iTunes account billed to a MasterCard ending in 7055 and issued to an Alexander Davros at 868 W. Hile, Muskegon, Mich.

The screenshots show the desiparker18@gmail.com address is associated with an Instagram account for a woman by the same name from Muskegon, Mich. (note that the address given in the WHOIS records for Alex Davros’s daily-streaming.com and tiny-chats.com also was Muskegon, Mich).

Desi Parker’s Instagram lists her “spouse” as Alex Davros, and says her phone number is 231-343-0295. Recall that this is the same phone number included in the Alex Davros domain registration records for daily-streaming.com and tiny-chats.com. That phone number is currently not in service.

Desi Parker’s Facebook account indeed says she is currently in a relationship with Alexander Marcus Davros, and the page links to this Facebook account for Alex Davros.

Alex’s Facebook profile is fairly sparse (at least the public version of it), but there is a singular notation in his entire profile that stands out: Beneath the “Other Names” heading under the “Details about Alexander” tab, Alex lists “TheKing.” Parker’s Instagram account includes a photo of an illustration she made including her beau’s first name with a crown on top.

Interestingly, two email addresses connected to domains associated with the Jeremy Wade alias — matt96sk@yahoo.com and skythekiddy@yahoo.com — are tied to Facebook accounts for Michigan residents who both list Alex Davros among their Facebook friends.

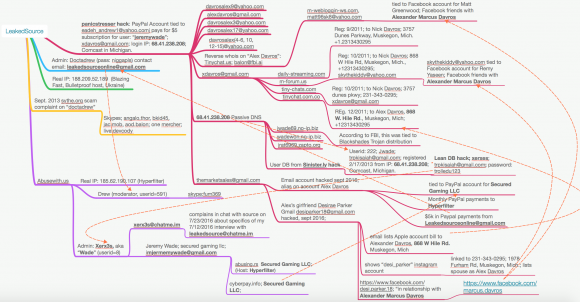

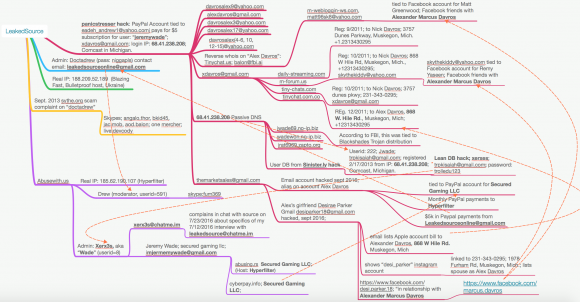

Below is a rough mind map I created which attempts to show the connections between the various aliases, email addresses, phone numbers and Internet addresses mentioned above. At a minimum, they strongly indicate that Xerx3s is indeed an administrator of LeakedSource.

I managed to reach Davros through Twitter, and asked him to follow me so that we could exchange direct messages. Within maybe 60 seconds of my sending that tweet, Davros followed me on Twitter and politely requested via direct message that I remove my public Twitter messages asking him to follow me.

I managed to reach Davros through Twitter, and asked him to follow me so that we could exchange direct messages. Within maybe 60 seconds of my sending that tweet, Davros followed me on Twitter and politely requested via direct message that I remove my public Twitter messages asking him to follow me.

After I did as requested, Davros’s only response initially was, “Wow, impressive but I can honestly tell you I am not behind the service.” However, when pressed to be more specific, he admitting to being Xerx3s but claimed he had no involvement in LeakedSource.

“I am xer yes but LS no,” Davros said. He stopped answering my questions after that, saying he was busy “doing a couple things IRL.” IRL is Internet slang for “in real life.” Presumably these other things he was doing while I was firing off more questions had nothing to do with activities like deleting profiles or contacting an attorney.

Even if Davros is telling the truth, the preponderance of clues here and the myriad connections between them suggest that he at least has close ties to some of those who are involved in running LeakedSource.

A “mind map” I created to illustrate the apparent relationships between various addresses and pseudonyms referenced in this story.

THE LEGALITY OF LEAKEDSOURCE

On the surface, the rationale that LeakedSource’s proprietors have used to justify their service may seem somewhat reasonable: The service merely catalogs information that is already stolen from companies and that has been leaked in some form online.

But legal experts I spoke with saw things differently, saying LeakedSource’s owners could face criminal charges if prosecutors could show LeakedSource intended for the passwords that are for sale on the site to be used in the furtherance of a crime.

Orin Kerr, director of the Cybersecurity Law Initiative at The George Washington University, said trafficking in passwords is clearly a crime under the Computer Fraud and Abuse Act (CFAA).

Specifically, Section A6 of the CFAA, which makes it a crime to “knowingly and with intent to defraud traffic in any password or similar information through which a computer may be accessed without authorization, if…such trafficking affects interstate or foreign commerce.

“CFAA quite clearly punishes password trafficking,” Kerr said. “The statute says the [accused] must be trafficking in passwords knowingly and with intent to defraud, or trying to further unauthorized access.”

Judith Germano, a senior fellow at the Center on Law and Security at New York University’s School of Law, said LeakedSource might have a veneer of legitimacy if it made an effort to check whether users already have access to the accounts for which they’re seeking passwords.

“If they’re not properly verifying that when the user goes to the site to get passwords then I think that’s where their mask of credibility falls,” Germano said.

LeakedSource may be culpable also because at one point the site offered to crack hashed or encrypted passwords for a fee. In addition, it seems clear that the people who ran the service also advocated the use of stolen passwords for financial gain.

In

In  The smartest option is probably to ditch the program once and for all and significantly increase the security of your system in the process. An extremely powerful and buggy program that binds itself to the browser, Flash is a favorite target of attackers and malware. For some ideas about how to hobble or do without Flash (as well as slightly less radical solutions) check out

The smartest option is probably to ditch the program once and for all and significantly increase the security of your system in the process. An extremely powerful and buggy program that binds itself to the browser, Flash is a favorite target of attackers and malware. For some ideas about how to hobble or do without Flash (as well as slightly less radical solutions) check out

![Exposed[dot]su was built with the help of identity information obtained and/or stolen from ssndob[dot]ru.](./media/f2651763.exposed-su-600x462.png)

![An associate of Xerx3s tells another abusewith[dot]us user that Xerx3s is the owner of LeakedSource. That comment was later deleted from the discussion thread pictured here.](./media/4fa5f417.xerownsit-580x252.png)

I managed to reach Davros

I managed to reach Davros

A spokesperson for Atlanta, Ga.-based Arby’s said the company was first notified by industry partners in mid-January about a breach at some stores, but that it had not gone public about the incident at the request of the FBI.

A spokesperson for Atlanta, Ga.-based Arby’s said the company was first notified by industry partners in mid-January about a breach at some stores, but that it had not gone public about the incident at the request of the FBI.