Past stories here have explored the myriad criminal uses of a hacked computer, the various ways that your inbox can be spliced and diced to help cybercrooks ply their trade, and the value of a hacked company. Today’s post looks at the price of stolen credentials for just about any e-commerce, bank site or popular online service, and provides a glimpse into the fortunes that an enterprising credential thief can earn selling these accounts on consignment.

Not long ago in Internet time, your typical cybercriminal looking for access to a specific password-protected Web site would most likely visit an underground forum and ping one of several miscreants who routinely leased access to their “bot logs.”

These bot log sellers were essentially criminals who ran large botnets (collections of hacked PCs) powered by malware that can snarf any passwords stored in the victim’s Web browser or credentials submitted into a Web-based login form. For a few dollars in virtual currency, a ne’er-do-well could buy access to these logs, or else he and the botmaster would agree in advance upon a price for any specific account credentials sought by the buyer.

Back then, most of the stolen credentials that a botmaster might have in his possession typically went unused or unsold (aside from the occasional bank login that led to a juicy high-value account). Indeed, these plentiful commodities held by the botmaster for the most part were simply not a super profitable line of business and so went largely wasted, like bits of digital detritus left on the cutting room floor.

But oh, how times have changed! With dozens of sites in the underground now competing to purchase and resell credentials for a variety of online locations, it has never been easier for a botmaster to earn a handsome living based solely on the sale of stolen usernames and passwords alone.

If the old adage about a picture being worth a thousand words is true, the one directly below is priceless because it illustrates just how profitable the credential resale business has become.

This screen shot shows the earnings panel of a crook who sells stolen credentials for hundreds of Web sites to a dark web service that resells them. This botmaster only gets paid when someone buys one of his credentials. So far this year, customers of this service have purchased more than 35,000 credentials he’s sold to this service, earning him more than $288,000 in just a few months.

The image shown above is the wholesaler division of “Carder’s Paradise,” a bustling dark web service that sells credentials for hundreds of popular Web destinations. The screen shot above is an earnings panel akin to what you would see if you were a seller of stolen credentials to this service — hence the designation “Seller’s Paradise” in the upper left hand corner of the screen shot.

This screen shot was taken from the logged-in account belonging to one of the more successful vendors at Carder’s Paradise. We can see that in just the first seven months of 2017, this botmaster sold approximately 35,000 credential pairs via the Carder’s Paradise market, earning him more than $288,000. That’s an average of $8.19 cents for each credential sold through the service.

Bear in mind that this botmaster only makes money based on consignment: Regardless of how much he uploads to Seller’s Paradise, he doesn’t get paid for any of it unless a Seller’s Paradise customer chooses to buy what he’s selling.

Fortunately for this guy, almost 9,000 different customers of Seller’s Paradise chose to purchase one or more of his username and password pairs. It was not possible to tell from this seller’s account how many credential pairs total that he has contributed to this service which went unsold, but it’s a safe bet that it was far more than 35,000.

[A side note is in order here because there is some delicious irony in the backstory behind the screenshot above: The only reason a source of mine was able to share it with me was because this particular seller re-used the same email address and password across multiple unrelated cybercrime services].

Based on the prices advertised at Carder’s Paradise (again, Carder’s Paradise is the retail/customer side of Seller’s Paradise) we can see that the service on average pays its suppliers about half what it charges customers for each credential. The average price of a credential for more than 200 different e-commerce and banking sites sold through this service is approximately $15.

Part of the price list for credentials sold at this dark web ID theft site.

Indeed, fifteen bucks is exactly what it costs to buy stolen logins for airbnb.com, comcast.com, creditkarma.com, logmein.com and uber.com. A credential pair from AT&T Wireless — combined with access to the victim’s email inbox — sells for $30.

The most expensive credentials for sale via this service are those for the electronics store frys.com ($190). I’m not sure why these credentials are so much more expensive than the rest, but it may be because thieves have figured out a reliable and very profitable way to convert stolen frys.com customer credentials into cash.

Usernames and passwords to active accounts at military personnel-only credit union NavyFederal.com fetch $60 apiece, while credentials to various legal and data aggregation services from Thomson Reuters properties command a $50 price tag.

The full price list of credentials for sale by this dark web service is available in this PDF. For CSV format, see this link. Both lists are sorted alphabetically by Web site name.

This service doesn’t just sell credentials: It also peddles entire identities — indexed and priced according to the unwitting victim’s FICO score. An identity with a perfect credit score (850) can demand as much as $150.

Stolen identities with high credit scores fetch higher prices.

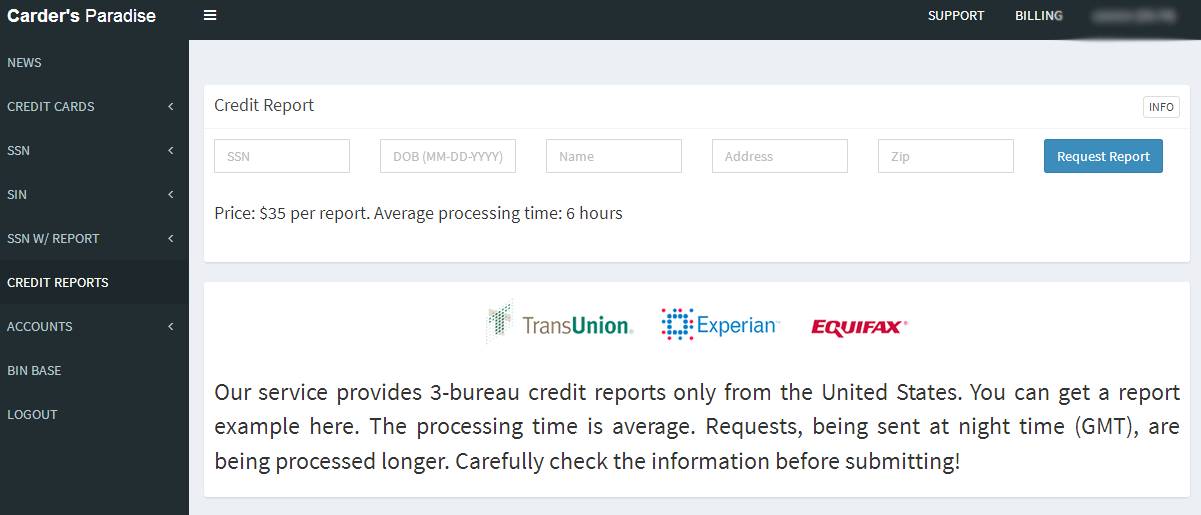

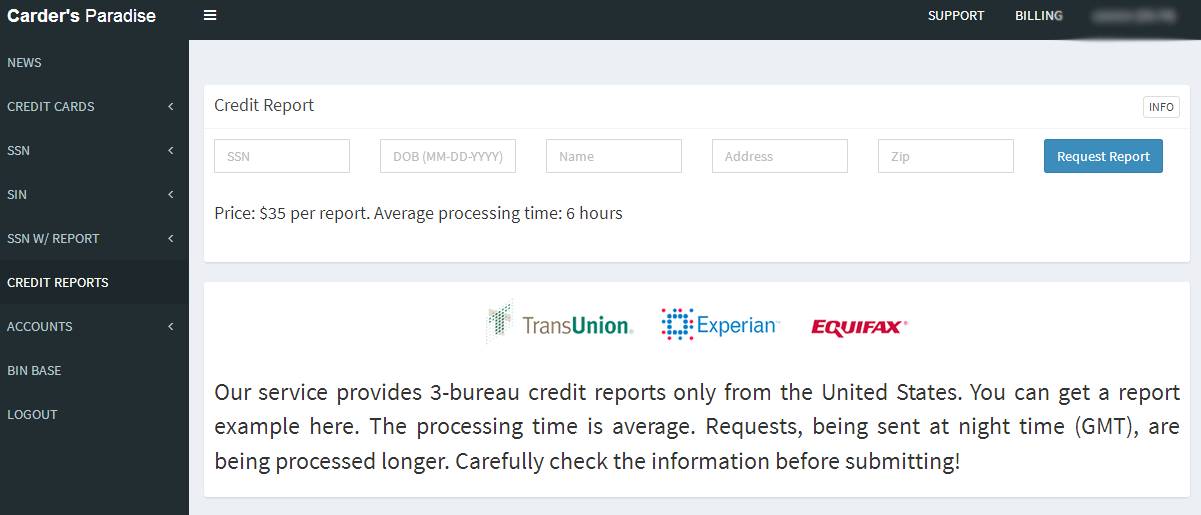

And of course this service also offers the ability to pull full credit reports on virtually any American — from all three major credit bureaus — for just $35 per bureau.

It costs $35 through this service to pull someone’s credit file from the three major credit bureaus.

Plenty of people began freaking out earlier this year after a breach at big-three credit bureau Equifax jeopardized the Social Security Numbers, dates of birth and other sensitive date on more than 145 million Americans. But as I have been trying to tell readers for many years, this data is broadly available for sale in the cybercrime underground on a significant portion of the American populace.

If the threat of identity theft has you spooked, place a freeze on your credit file and on the file of your spouse (you may even be able to do this for your kids). Credit monitoring is useful for letting you know when someone has stolen your identity, but these services can’t be counted on to stop an ID thief from opening new lines of credit in your name.

They are, however, useful for helping to clean up identity theft after-the-fact. This story is already too long to go into the pros and cons of credit monitoring vs. freezes, so I’ll instead point to a recent primer on the topic and urge readers to check it out.

Finally, it’s a super bad idea to re-use passwords across multiple sites. KrebsOnSecurity this year has written about multiple, competing services that sell or sold access to billions of usernames and passwords exposed in high profile data breaches at places like Linkedin, Dropbox and Myspace. Crooks pay for access to these stolen credential services because they know that a decent percentage of Internet users recycle the same password at multiple sites.

One alternative to creating and remembering strong, lengthy and complex passwords for every important site you deal with is to outsource this headache to a password manager. If the online account in question allows 2-factor authentication (2FA), be sure to take advantage of that.

Two-factor authentication makes it much harder for password thieves (or their customers) to hack into your account just by stealing or buying your password: If you have 2FA enabled, they also would need to hack that second factor (usually your mobile device) before being able to access your account. For a list of sites that support 2FA, check out twofactorauth.org.