The Hidden Cost of Ransomware: Wholesale Password Theft

lundi 6 janvier 2020 à 19:17Organizations in the throes of cleaning up after a ransomware outbreak typically will change passwords for all user accounts that have access to any email systems, servers and desktop workstations within their network. But all too often, ransomware victims fail to grasp that the crooks behind these attacks can and frequently do siphon every single password stored on each infected endpoint. The result of this oversight may offer attackers a way back into the affected organization, access to financial and healthcare accounts, or — worse yet — key tools for attacking the victim’s various business partners and clients.

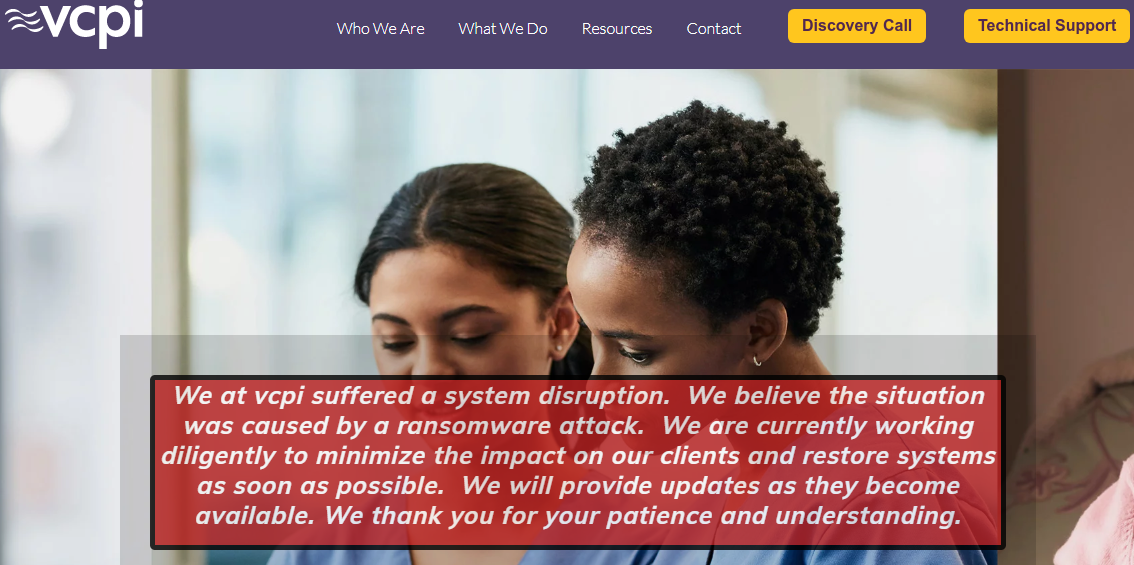

In mid-November 2019, Wisconsin-based Virtual Care Provider Inc. (VCPI) was hit by the Ryuk ransomware strain. VCPI manages the IT systems for some 110 clients that serve approximately 2,400 nursing homes in 45 U.S. states. VCPI declined to pay the multi-million dollar ransom demanded by their extortionists, and the attack cut off many of those elder care facilities from their patient records, email and telephone service for days or weeks while VCPI rebuilt its network.

Just hours after that story was published, VCPI chief executive and owner Karen Christianson reached out to say she hoped I would write a follow-up piece about how they recovered from the incident. My reply was that I’d consider doing so if there was something in their experience that I thought others could learn from their handling of the incident.

I had no inkling at the time of how much I would learn in the days ahead.

EERIE EMAILS

On December 3, I contacted Christianson to schedule a follow-up interview for the next day. On the morning of Dec. 4 (less than two hours before my scheduled call with VCPI and more than two weeks after the start of their ransomware attack) I heard via email from someone claiming to be part of the criminal group that launched the Ryuk ransomware inside VCPI.

That email was unsettling because its timing suggested that whoever sent it somehow knew I was going to speak with VCPI later that day. This person said they wanted me to reiterate a message they’d just sent to the owner of VCPI stating that their offer of a greatly reduced price for a digital key needed to unlock servers and workstations seized by the malware would expire soon if the company continued to ignore them.

“Maybe you chat to them lets see if that works,” the email suggested.

The anonymous individual behind that communication declined to provide proof that they were part of the group that held VPCI’s network for ransom, and after an increasingly combative and personally threatening exchange of messages soon stopped responding to requests for more information.

“We were bitten with releasing evidence before hence we have stopped this even in our ransoms,” the anonymous person wrote. “If you want proof we have hacked T-Systems as well. You may confirm this with them. We havent [sic] seen any Media articles on this and as such you should be the first to report it, we are sure they are just keeping it under wraps.” Security news site Bleeping Computer reported on the T-Systems Ryuk ransomware attack on Dec. 3.

In our Dec. 4 interview, VCPI’s acting chief information security officer — Mark Schafer, CISO at Wisconsin-based SVA Consulting — confirmed that the company received a nearly identical message that same morning, and that the wording seemed “very similar” to the original extortion demand the company received.

However, Schafer assured me that VCPI had indeed rebuilt its email network following the intrusion and strictly used a third-party service to discuss remediation efforts and other sensitive topics.

‘LIKE A COMPANY BATTLING A COUNTRY’

Christianson said several factors stopped the painful Ryuk ransomware attack from morphing into a company-ending event. For starters, she said, an employee spotted suspicious activity on their network in the early morning hours of Saturday, Nov. 16. She said that employee then immediately alerted higher-ups within VCPI, who ordered a complete and immediate shutdown of the entire network.

“The bottom line is at 2 a.m. on a Saturday, it was still a human being who saw a bunch of lights and had enough presence of mind to say someone else might want to take a look at this,” she said. “The other guy he called said he didn’t like it either and called the [chief information officer] at 2:30 a.m., who picked up his cell phone and said shut it off from the Internet.”

Schafer said another mitigating factor was that VCPI had contracted with a third-party roughly six months prior to the attack to establish off-site data backups that were not directly connected to the company’s infrastructure.

“The authentication for that was entirely separate, so the lateral movement [of the intruders] didn’t allow them to touch that,” Schafer said.

Schafer said the move to third-party data backups coincided with a comprehensive internal review that identified multiple areas where VCPI could harden its security, but that the attack hit before the company could complete work on some of those action items.

“We did a risk assessment which was pretty much spot-on, we just needed more time to work on it before we got hit,” he said. “We were doing the right things, just not fast enough. If we’d had more time to prepare, it would have gone better. I feel like we were a company battling a country. It’s not a fair fight, and once you’re targeted it’s pretty tough to defend.”

WHOLESALE PASSWORD THEFT

Just after receiving a tip from a reader about the ongoing Ryuk infestation at VCPI, KrebsOnSecurity contacted Milwaukee-based Hold Security to see if its owner Alex Holden had any more information about the attack. Holden and his team had previously intercepted online communications between and among multiple ransomware gangs and their victims, and I was curious to know if that held true in the VCPI attack as well.

Sure enough, Holden quickly sent over several logs of data suggesting the attackers had breached VCPI’s network on multiple occasions over the previous 14 months.

“While it is clear that the initial breach occurred 14 months ago, the escalation of the compromise didn’t start until around November 15th of this year,” Holden said at the time. “When we looked at this in retrospect, during these three days the cybercriminals slowly compromised the entire network, disabling antivirus, running customized scripts, and deploying ransomware. They didn’t even succeed at first, but they kept trying.”

Holden said it appears the intruders laid the groundwork for the VPCI using Emotet, a powerful malware tool typically disseminated via spam.

“Emotet continues to be among the most costly and destructive malware,” reads a July 2018 alert on the malware from the U.S. Department of Homeland Security. “Its worm-like features result in rapidly spreading network-wide infection, which are difficult to combat.”

According to Holden, after using Emotet to prime VCPI’s servers and endpoints for the ransomware attack, the intruders deployed a module of Emotet called Trickbot, which is a banking trojan often used to download other malware and harvest passwords from infected systems.

Indeed, Holden shared records of communications from VCPI’s tormentors suggesting they’d unleashed Trickbot to steal passwords from infected VCPI endpoints that the company used to log in at more than 300 Web sites and services, including:

-Identity and password management platforms Auth0 and LastPass

-Multiple personal and business banking portals;

-Microsoft Office365 accounts

-Direct deposit and Medicaid billing portals

-Cloud-based health insurance management portals

-Numerous online payment processing services

-Cloud-based payroll management services

-Prescription management services

-Commercial phone, Internet and power services

-Medical supply services

-State and local government competitive bidding portals

-Online content distribution networks

-Shipping and postage accounts

-Amazon, Facebook, LinkedIn, Microsoft, Twitter accounts

Toward the end of my follow-up interview with Schafer and VCPI’s Christianson, I shared Holden’s list of sites for which the attackers had apparently stolen internal company credentials. At that point, Christianson abruptly ended the interview and got off the line, saying she had personal matters to attend to. Schafer thanked me for sharing the list, noting that it looked like VCPI probably now had a “few more notifications to do.”

Moral of the story: Companies that experience a ransomware attack — or for that matter any type of equally invasive malware infestation — should assume that all credentials stored anywhere on the local network (including those saved inside Web browsers and password managers) are compromised and need to be changed.

Out of an abundance of caution, this process should be done from a pristine (preferably non-Windows-based) system that does not reside within the network compromised by the attackers. In addition, full use should be made of the strongest method available for securing these passwords with multi-factor authentication.

Stories here have exposed countless scams, data breaches, cybercrooks and corporate stumbles. In the ten years since its inception, the site has attracted more than 37,000 newsletter subscribers, and nearly 100 million pageviews generated by roughly 40 million unique visitors.

Stories here have exposed countless scams, data breaches, cybercrooks and corporate stumbles. In the ten years since its inception, the site has attracted more than 37,000 newsletter subscribers, and nearly 100 million pageviews generated by roughly 40 million unique visitors.